Minerva Humanoids

Investor Memo

This memo is confidential and intended solely for the use of the prospective investor to whom it is delivered.

EXECUTIVE SUMMARY

Company: Minerva Humanoids

Sector: Humanoid and Quadruped Robotics [Deeptech]

Investment Thesis:

Minerva is building a multimodal telepresence system that combines visual, haptic, and force sensing and actuation for humanoid robots in hazardous, life-critical environments where customers are cost-insensitive. Unlike competitors focused on household tasks and warehouse logistics, we target oil & gas and defense: a $20B+ annual opportunity with six-month customer ROI and, no competition for robotic intervention. Our founding team brings experience from Boston Dynamics, MIT, and Tesla Optimus, and we are advised by leaders from Google X, MIT CSAIL, and the UK Ministry of Defence, global authorities on bomb-disposal doctrine. Telepresence deployments generate immediate revenue and produce the multimodal manipulation data needed to train next-generation autonomous systems, creating a defensible moat in the most valuable robotics applications.

THE MARKET MISALIGNMENT OF HUMANOIDS

The humanoid robotics industry is chasing the wrong markets. Companies like Figure AI and 1X are building for households, where high variability and low value per task lead to delayed ROI, large liability exposure, and endless edge cases. The home robot insurance market is projected to reach $6B by 2033, signalling that insurers expect significant robot-caused injuries and property damage. Others, such as Apptronik, target logistics and warehousing, yet purpose-built robots like Boston Dynamics’ Stretch handle these tasks more efficiently than even humans.

Two massive markets remain unserved. In oil and gas operations, more than 100 workers die annually in the United States, and Deepwater Horizon alone cost $65B and 11 lives. Workers face hydrogen sulfide exposure, explosive atmospheres, and extreme temperatures every day. Existing robots only inspect; they cannot operate valves, perform emergency interventions, or conduct repairs. There is no teleoperated emergency-response solution for these environments.

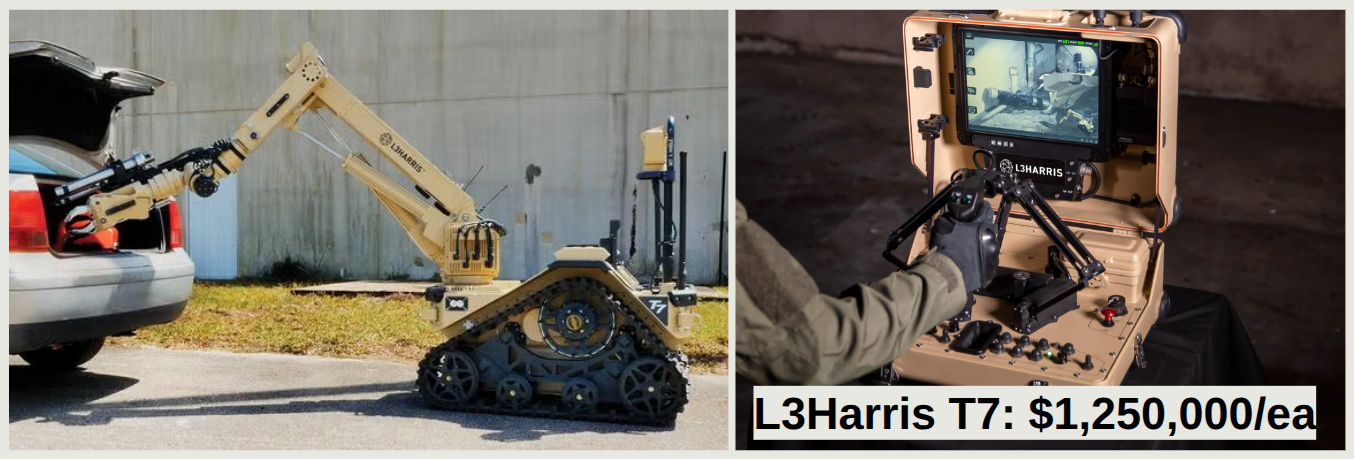

In defense, EOD technicians face a fatality rate six times the military average, with more than 300 killed in Iraq and Afghanistan. Current EOD robots cost about $1.2M each, move at 1-2 mph, have primitive manipulation capabilities, and require 40+ hours of training. CBRN operations still rely on humans in heavy, hot, and highly uncomfortable protective suits, limiting speed and mobility. These markets have no effective robotic solution and urgently need one.

THE MINERVA SOLUTION

Our approach rests on three technical pillars to create the first viable telepresent humanoid system for hazardous operations.

First, our intuitive telepresence system to accurately deliver human capabilities remotely powered by KHEIRON [Kinesthetic Hybrid Engine via Intelligent RL & OC Network]. On the operator side, there are two versions to interface with KHEIRON:

1. field-deployable (VR headset and haptic gloves)

2. full control room setup with a force-feedback exoskeleton, omnidirectional treadmill, and a whole-body haptic-feedback suit.

KHEIRON is our proprietary hybrid reinforcement learning (RL) and optimal control (OC) neural-retargeting network which allows the operator to intuitively manipulate tools, objects, and hazardous materials using the 5-finger hands. It's a state-of-the-art intuitive telepresence system that allows the operator to not only see a spatial view from the humanoid robot's head but also experience the feeling of manipulating objects in the remote environment in real-time.

KHEIRON combines deep reinforcement learning with Model Predictive Control to guarantee safety even when human operators make mistakes. Optimization-based barriers prevent robot self-damage and environmental collisions in real-time. The architecture achieves 100ms latency (10x better than current state-of-the-art) with 100-meter range through walls and 300-meter line-of-sight capability. AI-enhanced grasping, autonomous balance and fall recovery, and multi-spectrum vision switching provide intuitive emergency operation capabilities for oil & gas and defense.

Second, a pragmatic path to autonomy. Unlike companies betting everything on autonomous models that are fundamentally limited in their force-based understanding (hence will not be able to generalize beyond constrained environments with a limited set of objects: squishy deformables, fragile, and wierdly-shaped objects remaining unsolved), Minerva generates revenue from dayday one through human-guided telepresence. Every deployment using KHEIRON collects multimodal data (video, audio, force, and haptic feedback) from real-world hazardous operations, not staged lab environments. This expert demonstration data trains hybrid Vision-Language-Action models combined with limit-aware mid-level control, creating increasingly autonomous capabilities while maintaining safety constraints. The result is a data moat: the world's largest dataset for tactile manipulation in oil & gas and defense, which research has proven is critical for robust deployments in these spaces.

Third, our custom telepresence hardware. On the operator side, the system scales from field-deployable (VR headset and haptic gloves) to full control room setups with exoskeletons, omnidirectional treadmills, and whole-body haptic suits. On the robot side, custom dexterous hands with custom developed tactile e-skin deliver unprecedented force capacity and tactile resolution. MIL-spec streaming equipment, multi-camera arrays (visual, IR, thermal, depth), and specialized EOD/CBRNE equipment complete the platform by providing the ability to operate dangerous, compromised environments. Our hardened off-the-shelf equipment enables sustained operational reliability and robustness tailored to critical life-saving missions.

MARKET OPPORTUNITY

The oil and gas market represents more than $5B in annual SAM across North America, Europe, and the Middle East GCC. The sector has demand for automation: in 2024 Aramco spent $1.6B on robotics and automation R&D, ADNOC spent $920M, and ExxonMobil spent $1B. They are motivated by the extreme costs of injuries and fatalities (disability, rehabilitation, training replacements, regulatory fines, operational delays) as well as mounting security and personnel safety requirements due to regional conflicts.

The economics are compelling. Across these regions there are ~624,000 workers, with 10% in hazardous roles. A conservative 20% replacement by 2030 implies 12,480 robots needed. At $100,000 per robot amortized over five years, $30,000 annual software licensing and $20,000 annual service, the SAM reaches $850+M annually by 2030. Customer ROI is under six months: preventing a single incident can save $10M or more, and preventing fatalities and improving disaster mitigation can save $65B, as the Deepwater Horizon incident demonstrated. Buyers are cost-insensitive when the stakes are this high.

The target deployment infrastructure is substantial: over 1,500 offshore rigs operating 24/7 globally, 600+ major refineries worldwide, 5,000+ petrochemical plants, and numerous terminals and storage facilities. ADNOC alone operates 146 rigs with over 8,000 drilling staff. The applications span emergency valve operations, damage control, hazmat handling, and drilling in toxic zones with high concentrations of hydrogen sulfide.

The defense market adds a second dimension. The military land robotics market is $~10-$16B annually in 2025, with more than 10,000 EOD/CBRN personnel in the United States facing rising terrorism threats. Current systems such as the L3Harris T7 cost ~$1.25M each, with the UK MoD recently purchasing 56 units for $70M. Minerva targets roughly 10x faster task completion through spatial VR telepresence, human-level dexterity instead of joystick control, and sharply reduced training time, at comparable or lower cost.

THE FOUNDING TEAM

Sandor Felber led humanoid robotics research at MIT CSAIL and scaled Tesla Optimus actuator-control software and testing to 100x throughput. He previously led the 150+ person, #1 UK autonomous racing engineering team. Recent work includes whole-body reinforcement learning controllers for PAL, Unitree, and Booster humanoids, and teleoperation with tactile feedback using safe trajectory optimization on the Kawada Nextage.

Maurice Rahme, former Tech Lead for Manipulation at Boston Dynamics, took Stretch from prototype to commercial product, handling 16M+ payloads across 100+ deployed robots with ~150-hour MTBF. He holds multiple patents on safe manipulation and wrote the manufacturing software used to build more than 100 robots. His contributions include 2x faster trajectories, 50% higher payload capacity on identical hardware, and tightly constrained collision-avoidance systems. He also designed and deployed the Open Quadruped with reinforcement learning locomotion (1k GitHub stars). He grew up in Saudi Arabia and Dubai, enabling natural access to Middle East oil and gas customers.

The advisory board provides exceptional strategic value. Gabe Margolis and Nolan Fey are humanoid learning researchers at MIT CSAIL. Hans Peter Brondmo served as a Google VP and as CEO of Everyday Robots. Dom Asquith is the UK MoD’s deputy Explosive Ordnance Disposal lead, effectively “Customer #2” for defense applications. Al Brown leads AI and robotics for the UK MoD and led high-risk search regiments in Afghanistan. This combination of technical credibility, commercial experience, and direct customer access is rare in early-stage robotics.

BUSINESS MODEL AND UNIT ECONOMICS

Minerva’s revenue model adds streams as we scale. In years 1 to 3, primary revenue comes from robot sales, software licensing, and service and maintenance. In year 2, we add SaaS licenses of our telepresence stack for robotics companies and research universities, targeting the teleoperated industrial robot market projected at $40B by 2030; these licenses include anonymized data-collection agreements. By year 3, long-term revenue comes from data licensing of the world’s largest multimodal manipulation dataset and from hybrid autonomous operations in which a single human operator supervises fleets and can take manual control when needed.

Best-in-class unit economics (for legged mobile robots). Over a five-year robot life, hardware generates $100,000 in one-time revenue, software licensing adds $150,000, and service contributes another $100,000, for a total of $350,000 per robot. Customer savings dwarf this spend: preventing a single incident can save more than $10M, delivering ROI in under six months. Because these deployments involve life safety, buyers are cost-insensitive; they are purchasing zero-casualty and zero-disruption operations.

Go-to-market begins with pilot deployments in months 1 to 8. In oil and gas, ADNOC is the ideal first customer with 146 rigs and more than 8,000 drilling staff. Entry points include emergency valve operations and confined-space entry, with proof-of-concept demonstrations at mocked training facilities. In defense, advisor relationships provide direct access to the UK Ministry of Defence, with initial demonstrations at NATO-affiliated CBRN training sites and validation by EOD and CBRN subject-matter experts.

Years 1 to 2 focus on scaling through direct sales to oil and gas majors including Aramco, ADNOC, ExxonMobil, Shell, and BP, with emphasis on the Middle East where automation spend and security needs are highest. Defense contracts expand to the USAF, US Army EOD, NATO allies, and domestic agencies such as DHS and HAZMAT teams. By years 2 to 3, we enter adjacent markets like mining, nuclear operations, and space, and we launch the autonomous supervision platform for fleet management.

RISKS AND MITIGATION

Technical risks center on periodic verifiable deployment milestones. We are able to do this, because we are not building a research lab that is trying to research, develop, and commercialize the next generation of general purpose fully-autonomous robots but instead we limit ourselves to operating in our target domains and to commercializing proven technology, not research. Our philosophy follows a pragmatic, step-by-step verifiable, down-to-Earth approach with frequent checkpoints for our progress in getting our robots to do real work. Our previous work demonstrates that the goals and milestones are achievable and even degraded performance would significantly exceed current state-of-the-art. We mitigate humanoid hardware supply-chain delays or quality issues by concurrently working with multiple partners and the hardware-agnostic design of the telepresence stack (limited to humanoids though).

Market risks require more nuance. Oil and gas customers can be slow to adopt innovation but our warm-introductions from Maurice's personal network (having grown up in Dubai and Saudi Arabia) provide for an unfair advantage in becoming a key supplier to the demonstrated demand: the $2B+ in annual automation spending in the Middle East shows clear appetite for innovation and improved health and safety. Maurice's in-depth knowledge of the oil and gas industry as well as his extensive experience leading Stretch pilots gives us good insights into what customer success looks like. Advisor relationships provide warm introductions and planned pilot-based sales reduce our risk. Defense procurement cycles are long, but the dual-use strategy means oil and gas revenue funds development toward military readiness. UK MoD advisor relationships significantly de-risk defense sales, and commercial hazmat and EOD applications can generate earlier revenue while defense contracts mature.

Competitive risks exist despite the current clear field. If Boston Dynamics enters the market, they remain focused on industrial inspection with Spot. Atlas hasn't commercialized despite years of development and seems to be focused on automotive likely because their owner, Hyundai pledged to order 10,000s of Atlases for their automotive factories. If Figure AI or 1X pivot to hazardous operations, they lack domain expertise, customer relationships, and the safety-critical experience that Minerva is building now. More importantly, Minerva will have a two-to-three year head start on accumulating the data moat that matters most. As Paul Graham wrote, "it's easier to innovate when you're the original of something. People copying you can only copy a snapshot of your current state. They don't know which aspects of the snapshot are essential and which are random things you'd been about to change anyway."

Execution risks around hiring robotics talent are mitigated by the founders' pedigree and existing technical networks: Boston Dynamics, MIT, and Tesla credentials attract top engineers.

OUTLOOK

Technology risk is significantly de-risked through the founders' previous work proving core concepts in locomotion, manipulation, and telepresence at commercial scale. The advisor network provides direct customer access through UK MoD relationships and industry connections rather than cold outreach. Market timing aligns perfectly: humanoid hardware is reaching the inflection point with below $100K units arriving in 2025-2026 (some as low as $6k), market awareness is at an all-time high creating customer receptiveness, yet incumbent competitors remain fundamentally misaligned on applications.

Comparable exits provide valuation context. Boston Dynamics sold to Hyundai for $1.1B in 2020 focusing on industrial and logistics robots. Sarcos Robotics SPACed at $1.3B valuation in 2021 with teleoperated industrial exoskeletons. Shield AI reached $2.7B valuation in 2024 building autonomous defense systems. Figure AI hit $39B valuation in 2025 despite targeting household applications. Minerva's combination of better markets in hazardous operations, superior technology in telepresence plus autonomy, and proven team with shipping experience suggests comparable or superior outcomes.

This memo is confidential and intended solely for the use of the prospective investor to whom it is delivered.